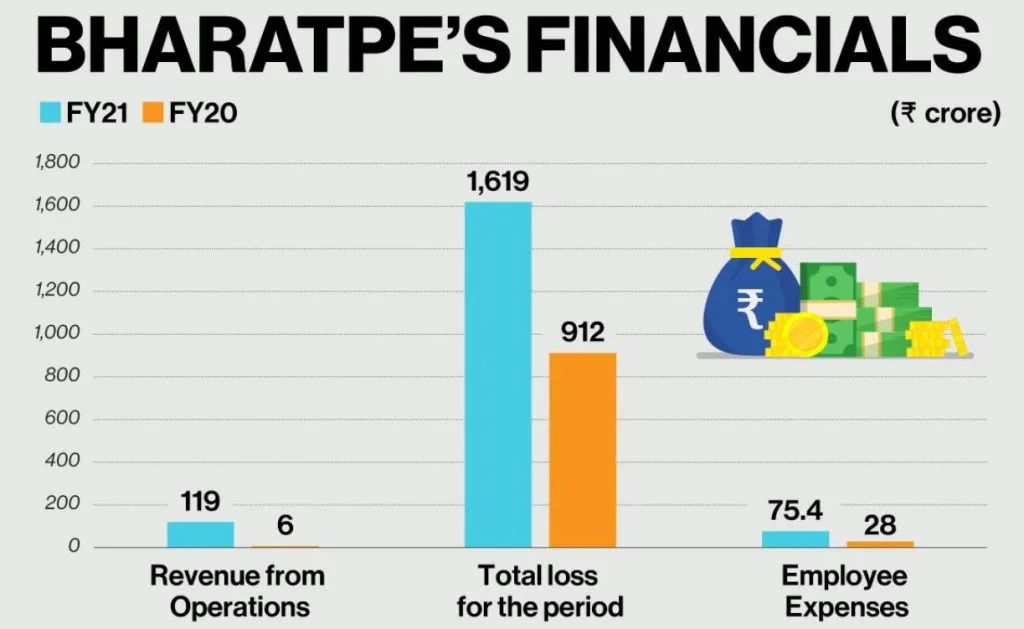

According to company papers obtained by BT from business intelligence platform Tofler, BharatPe’s losses nearly quadrupled to Rs 1619 crore in FY21 from Rs 912 crore in FY20, even though revenue from operations increased to Rs 119 crore in FY21 from Rs 6 crore in FY20. Employee engagement costs have also increased dramatically, up to Rs 75.4 crore in FY21 from Rs 28 crore the previous year.

According to a BharatPe spokesperson, the company has $400 million in cash flow for FY22 and will not be raising more money. The company’s monthly cash burn is $4 million, according to the report. The fintech firm also stated that it hopes to reach a revenue target of $300 million in FY23, with revenue of roughly $100 million as of March 2022.

According to the company’s statement, BharatPe’s consumer-facing buy now, pay later (BNPL) service, branded PostPe, reached $50 million in total payment volume in March 2022. In addition, the platform claims to have onboarded 8 million merchants in FY22, up from 5 million in FY21.

“We closed the year (FY22) with a bang! Our all-time best month, in an all-time best quarter. 15-40% growth across all metrics. Amazed at the brilliant execution by our teams; and more importantly, by our mission of solving the payment and credit needs of Bharat! On another note, we have decided to be more transparent, and I would be sharing quarterly movement on our most important metrics here,” wrote BharatPe CEO Suhail Sameer in a LinkedIn post.